INDEX

- Understanding Income from House Property

Types of Properties under the Income Tax Act

When is Income from House Property Taxable?

Deductions on Income from House Property

How to Calculate Income from House Property?

Income from House Property

1. What’s “Income from House Property”?

Simply put: it’s the income (or notional income) you earn from owning a house or building.

If you rent it out — that’s rent income.

If it’s just sitting there — it might still count as income (because, you know, tax rules).

All of this is governed by Sections 22 to 27 of the Income Tax Act, 1961 — the part of the law that decides how your home’s financial story plays out.

2. The Four Faces of Property (According to the Taxman)

1. Self-Occupied Property (SOP)

This is the house where you or your family actually live — your home sweet home.

Even if it’s locked up (say, your parents’ house in your hometown), it still counts as “self-occupied.”

Tax twist: Since FY 2019–20, you can treat two houses as self-occupied. The rest? Automatically become “let-out” for tax purposes — even if you’ve never seen a tenant’s shadow there.

2. Let-Out Property (LOP)

If you rent it out — even part of it — congratulations, it’s a let-out property.

This includes properties you inherited or co-own, as long as rent is coming in.

Tax angle: The rent (actual or deemed) is taxable, but you get to knock off some deductions — we’ll get to those soon.

3. Deemed Let-Out Property (DLOP)

This one’s sneaky. You didn’t rent the property, but you could have — so the tax department assumes you did.

Example: You own three houses but live in one. Two can be “self-occupied,” but that third one? The taxman says, “Let’s pretend you rented it out.”

Tax rule: You pay tax on a hypothetical rent value, but you can still claim deductions like municipal taxes and home loan interest.

4. Under-Construction Property

Bought a place that’s still just a pile of cement dreams? No worries. While it’s under construction, you don’t owe any tax on it.

But once it’s done, the property joins the self-occupied or let-out gang — and gets taxed accordingly.

3. When Does It Become Taxable?

You’ll be taxed if:

You earn rent or lease income, or

The property has a notional annual value above zero, or

You’ve leased it for 12 years or more, or

You’re a deemed owner (someone who technically transferred ownership but still enjoys control).

Basically, if it’s your property and it’s providing income (even imaginary), the IT department wants a word.

4. Deductions That Can Save Your Wallet (Section 24 Goodies)

Here’s where you can legally trim down your taxable income:

🏠 Standard Deduction: 30% flat on the Net Annual Value (NAV). No receipts, no drama.

💸 Interest on Home Loan:

Up to ₹2,00,000 for self-occupied properties.

No cap for let-out properties.

Only valid if the loan was for buying, building, or fixing up the house — and done within five years.

🏛️ Municipal Taxes: Whatever you paid to your local corporation — deductible from the gross annual value.

⏳ Pre-Construction Interest: Deductible up to ₹2,00,000, spread over five years.

🎉 First-Time Buyer Bonus (Section 80EE): Extra ₹50,000 off on interest, if your property is under ₹45 lakhs and loan under ₹35 lakhs.

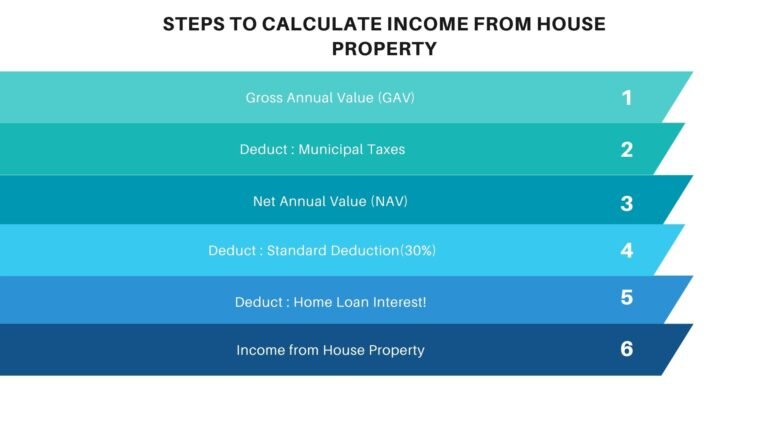

5. How to Calculate Income from House Property

Here’s a step-by-step guide on how to calculate income from house property:

| Step | Calculation Component | Formula |

|---|---|---|

| 1 | Gross Annual Value (GAV) | For let-out property, it is the rent received. For self-occupied property, GAV = 0. |

| 2 | Municipal Tax Deduction | Deduct the annual municipal taxes paid from GAV. |

| 3 | Net Annual Value (NAV) | NAV = GAV – Municipal Tax Deduction |

| 4 | Standard Deduction | 30% of NAV (for all rental properties). |

| 5 | Interest on Home Loan | Deduct interest paid on home loan (up to ₹2,00,000 for self-occupied property). |

| 6 | Final Income from House Property | Income = NAV – Standard Deduction – Interest on Home Loan. |

Example:

Mr. A’s income from house property for FY 2023-24 and FY 2024-25, considering one self-occupied property, one rented property, and one vacant property. Each property has municipal taxes of ₹16,000 paid and interest of ₹1,00,000 for the let-out property. This analysis is done under both the old tax regime and the new tax regime.

Income from House Property (Old Tax Regime)

| Particulars | FY 2023-24 | FY 2024-25 |

|---|---|---|

| Self-Occupied Property | ₹0 (No Income) | ₹0 (No Income) |

| Rented Property (Per Property) | ₹2,40,000 (₹20,000 × 12) | ₹2,40,000 (₹20,000 × 12) |

| Less: Municipal Taxes Paid (Per Property) | ₹16,000 | ₹16,000 |

| Net Rent Received (Rented Property) | ₹2,24,000 | ₹2,24,000 |

| Interest on Loan for Let-out Property | ₹1,00,000 | ₹1,00,000 |

| Gross Income from Let-out Property | ₹1,24,000 | ₹1,24,000 |

| Less: Standard Deduction (30%) | ₹37,200 (30% of ₹1,24,000) | ₹37,200 (30% of ₹1,24,000) |

| Net Income from House Property | ₹86,800 | ₹86,800 |

| Vacant Property | ₹0 (No Income) | ₹0 (No Income) |

| Total Income from House Property | ₹86,800 | ₹86,800 |

Explanation (Old Tax Regime):

- Self-Occupied Property: No income is generated from the self-occupied property, and no deductions are allowed.

- Rented Property: Annual rental income of ₹2,40,000 (₹20,000 per month) is generated from the rented property. After deducting municipal taxes of ₹16,000, the net rental income becomes ₹2,24,000. Mr. A also pays ₹1,00,000 in interest for the let-out property, which is deductible. After applying the 30% standard deduction on the remaining income of ₹1,24,000, the taxable income becomes ₹86,800.

- Vacant Property: No rental income and no deductions available.

So, the total income from house property for FY 2023-24 and FY 2024-25 is ₹86,800 under the old tax regime.

Income from House Property (New Tax Regime)

| Particulars | FY 2023-24 | FY 2024-25 |

|---|---|---|

| Self-Occupied Property | ₹0 (No Income) | ₹0 (No Income) |

| Rented Property (Per Property) | ₹2,40,000 (₹20,000 × 12) | ₹2,40,000 (₹20,000 × 12) |

| Less: Municipal Taxes Paid (Per Property) | ₹16,000 | ₹16,000 |

| Net Rent Received (Rented Property) | ₹2,24,000 | ₹2,24,000 |

| Interest on Loan for Let-out Property (Per Property) | ₹1,00,000 | ₹1,00,000 |

| Gross Income from Let-out Property | ₹1,24,000 | ₹1,24,000 |

| Less: Standard Deduction (30%) | ₹37,200 (30% of ₹1,24,000) | ₹37,200 (30% of ₹1,24,000) |

| Net Income from House Property | ₹86,800 | ₹86,800 |

| Vacant Property | ₹0 (No Income) | ₹0 (No Income) |

| Total Income from House Property | ₹86,800 | ₹86,800 |

Explanation (New Tax Regime):

- Self-Occupied Property: Similar to the old tax regime, no income is generated from the self-occupied property, and no deductions are allowed for this property.

- Rented Property: Mr. A receives ₹2,40,000 annually from the rented property (₹20,000 per month). After deducting the municipal taxes of ₹16,000, the net rental income becomes ₹2,24,000. Mr. A also has ₹1,00,000 in interest on loan for the let-out property, which is deductible under the new tax regime. After subtracting the interest, the gross income from the let-out property is ₹1,24,000. The standard 30% deduction is applied to the remaining income (₹1,24,000), resulting in ₹37,200 as a deduction. After this, the taxable income is ₹86,800.

- Vacant Property: No rental income and no deductions available. If Mr A has more than two vacanted properties (3 or more) house property than deemed income from one property will be taxable under house property.

The total income from house property for FY 2023-24 and FY 2024-25 is ₹86,800 under the new tax regime as well.

Thus, Mr. A’s total taxable income from house property remains ₹86,800 for both FY 2023-24 and FY 2024-25, under both the old and new tax regimes.

Final Thoughts

Owning property sounds glamorous until you meet the fine print. But once you get the hang of how income, deductions, and “deemed rent” work, it’s not so bad. Keep your records straight, claim every deduction you can, and maybe—just maybe—you’ll actually smile the next time your CA mentions Section 24.