INDEX

Budget 2024 Update

What is Capital Gains Tax

Defining Capital Assets

Tax Rates for Capital Gains

Changes in Debt Mutual Funds

Asset Classification

Notes on Inherited Assets

Example of Income from Capital Gains for FY 2023-24

- Example of Income from Capital Gains for FY 2024-25

Income from Capital Gain

1. Budget 2024 Highlights — The Big Shake-Up

Here’s what’s new (and worth paying attention to):

Two categories now rule the game: holding periods are down to just 12 months and 24 months. The old 36-month wait? Gone.

Listed securities: Hold them for more than 12 months, and they count as long-term.

Everything else: needs a 24-month hold to hit long-term status.

STCG (Short-Term Capital Gains): The tax on listed shares, equity mutual funds, and REITs jumps from 15% → 20%.

LTCG (Long-Term Capital Gains):

Exemption limit raised: ₹1 lakh → ₹1.25 lakh.

But tax rate up too: 10% → 12.5% (from July 23, 2024).

Other long-term assets: Tax rate trimmed from 20% to 12.5%, but (brace yourself) no more indexation.

For old real estate (bought before July 23, 2024): you can choose:

12.5% without indexation, or

20% with indexation.

Yep — more options, more math, more coffee.

2. What’s a Capital Gains Tax Anyway?

In plain talk, capital gains tax is what you pay when you make a profit from selling a capital asset — basically, anything valuable that’s not a regular part of your business stock.

You only pay this tax when you sell or transfer the asset — not while you’re just holding it and admiring it.

🧩 Types of Capital Gains

1. Short-Term Capital Gains (STCG)

Quick flips. You sold your asset before hitting the required holding period.

For most assets: held under 36 months.

For listed shares, mutual funds, and bonds: less than 12 months.

Taxed at slab rates or special rates (like 15% → now 20% for equities).

2. Long-Term Capital Gains (LTCG)

The “patient investor” tax.

For most assets: held beyond 36 months (or 24 months for property).

Lower tax rate, but until now you got indexation — adjusting for inflation.

From FY 2024–25: lower rate (12.5%) but no indexation.

3. What Counts as a Capital Asset?

Think of it as your “valuable possessions” list:

✅ Land, buildings, houses

✅ Vehicles, jewelry, machinery

✅ Shares, mutual funds, bonds, patents, trademarks

But not everything qualifies. These don’t count:

❌ Business inventory or raw materials

❌ Personal-use stuff like furniture and clothes

❌ Rural agricultural land

❌ Certain government bonds or gold savings schemes

Rural Land — Still Safe from Tax

Your farmland is tax-free if it’s outside city limits.

The taxman’s measuring tape goes like this:

Beyond 2 km from a town (pop. 10,000–1 lakh)

Beyond 6 km from a city (pop. 1–10 lakh)

Beyond 8 km from a metro (pop. over 10 lakh)

Basically, if your field’s far enough from the nearest Starbucks, you’re probably safe.

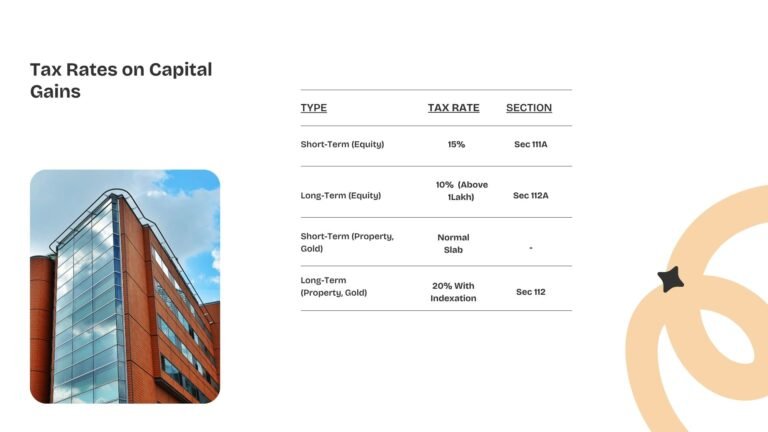

4. Capital Gains Tax Rates for FY 2024–25

| Type | Asset | Tax Rate (Before July 23, 2024) | Tax Rate (After July 23, 2024) |

|---|---|---|---|

| LTCG | Listed shares / equity mutual funds | 10% (on gains > ₹1 lakh) | 12.5% (on gains > ₹1.25 lakh) |

| LTCG | Other assets (property, gold, etc.) | 20% | 12.5% (no indexation) |

| STCG | Listed shares / equity funds | 15% | 20% |

| STCG | Other assets | Slab rates | Slab rates |

📝 Debt mutual funds are now always short-term — no indexation, no long-term perks.

5. Changes in Debt Mutual Funds (2023)

Gains from debt mutual funds are now always taxed as short-term. Additionally, indexation benefits for these funds are no longer available.

6. Holding Periods (FY 2024–25 Onward)

12 months: Listed securities (shares, bonds, ETFs, REITs).

24 months: Everything else — property, unlisted shares, etc.

Inherited or gifted assets? The original owner’s holding period counts.

Bonus/rights shares? The clock starts from the date of allotment.

7. Example of Income from Capital Gains for FY 2023-24

Transaction 1: Sale of shares on 10 July 2023

- Sale Date: 10 July 2023

- Sale Value: ₹5,20,000

- Purchase Date: 1 June 2020

- Purchase Value: ₹1,50,000

Transaction 2: Sale of shares on 5 August 2023

- Sale Date: 5 August 2023

- Sale Value: ₹2,00,000

- Purchase Date: 5 April 2023

- Purchase Value: ₹70,000

Calculation of Capital Gains & Tax for FY 2023-24:

| Transaction | Sale Date | Sale Value (₹) | Purchase Date | Purchase Value (₹) | Capital Gain (₹) | Taxable Gain (₹) | Tax Rate | Tax Payable (₹) |

|---|---|---|---|---|---|---|---|---|

| 1. Long-Term Capital Gain (LTCG) | 10 July 2023 | 5,20,000 | 1 June 2020 | 1,50,000 | 3,70,000 | ₹3,70,000-₹1,00,000= ₹2,70,000 | 10% | 27,000 |

| 2. Short-Term Capital Gain (STCG) | 5 August 2023 | 2,00,000 | 5 April 2023 | 70,000 | 1,30,000 | 1,30,000 | 15% | 19,500 |

| Total Capital Gains Tax Payable | 46,500 |

This table summarizes both the capital gains and the corresponding taxes for each transaction. The total tax payable is ₹46,500.

8. Example of Income from Capital Gains for FY 2024-25

Transaction 1: Sale of shares on 10 July 2024

- Sale Date: 10 July 2024

- Sale Value: ₹5,20,000

- Purchase Date: 1 June 2020

- Purchase Value: ₹1,50,000

Transaction 2: Sale of shares on 5 August 2024

- Sale Date: 5 August 2024

- Sale Value: ₹2,00,000

- Purchase Date: 5 April 2024

- Purchase Value: ₹70,000

Calculation of Capital Gains & Tax for FY 2024-25:

| Transaction | Sale Date | Sale Value (₹) | Purchase Date | Purchase Value (₹) | Capital Gain (₹) | Taxable Gain (₹) | Tax Rate | Tax Payable (₹) |

|---|---|---|---|---|---|---|---|---|

| 1. Long-Term Capital Gain (LTCG) | 10 July 2024 | 5,20,000 | 1 June 2020 | 1,50,000 | 3,70,000 | ₹3,70,000 – ₹1,25,000 = ₹2,45,000 | 12.5% | 30,625 |

| 2. Short-Term Capital Gain (STCG) | 5 August 2024 | 2,00,000 | 5 April 2024 | 70,000 | 1,30,000 | 1,30,000 | 20% | 26,000 |

| Total Capital Gains Tax Payable | 56,625 |

Total Tax Payable for FY 2024-25:

- Total Tax from LTCG: ₹30,625

- Total Tax from STCG: ₹26,000

Total Tax Payable = ₹30,625 + ₹26,000 = ₹56,625

So, Mr. A will have to pay a total of ₹56,625 as tax for FY 2024-25 on the capital gains from these two transactions.

Final Thoughts

Capital gains tax has always been a balancing act between rewarding long-term investors and collecting fair revenue. Budget 2024 simplifies the system — but not without some sting.

If you invest often, or plan to sell big assets, keep your holding periods and sale dates in check. A few months here or there could literally save (or cost) you thousands.

And if the numbers make your head spin? That’s what spreadsheets — and patient tax professionals — are for.