INDEX

- What is Input Tax Credit (ITC)

- How ITC Works

- Conditions For Claiming ITC Under GST

- ITC on Capital Goods

- ITC Utilisation and Sequence for CGST, SGST & IGST

- Common Pitfalls in CLaiming ITC

Real-Life Example

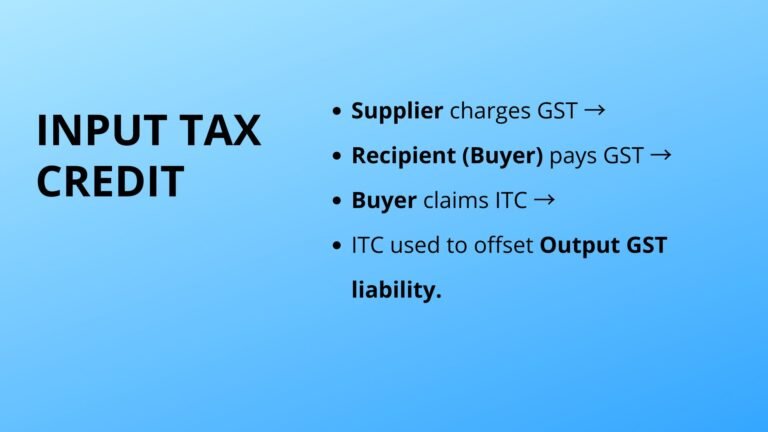

Input Tax Credit (ITC) Under GST

Input Tax Credit (ITC) Under GST: Making Sense of the Tax You’ve Already Paid

Ever bought something for your business, paid GST on it, and thought, “Wait, why am I paying tax on tax?”

That’s exactly what Input Tax Credit (ITC) fixes.

Under India’s Goods and Services Tax (GST) system, ITC is the secret sauce that keeps businesses from getting taxed at every step of production. It lets you set off the GST you’ve already paid on purchases against the GST you collect on sales.

In simple terms: you only pay tax on your value addition, not on the whole chain.

Efficient, fair, and surprisingly logical — at least by tax standards.

1. What Exactly Is ITC?

Think of ITC as a refund mechanism — not a direct cashback, but a balance adjustment.

Let’s say you’re a manufacturer buying raw materials worth ₹1,00,000. You pay ₹18,000 as GST on that purchase.

When you sell your finished product, that ₹18,000 becomes your credit — you can use it to reduce the GST you owe the government.

So instead of paying double taxes, you only pay on your value-added margin. Pretty neat, right?

2. The Ground Rules: Who Can Actually Claim ITC?

You can’t just wave an invoice and expect the tax gods to bless you with credits. There are a few boxes you’ve got to tick:

✅ 1. You Must Be a Registered GST Business

No GST registration, no ITC. It’s that simple.

✅ 2. It Must Be for Business Use

Bought furniture for your office? Great — ITC applies.

Bought the same furniture for your living room? Nice try, but nope. Personal use = no credit.

✅ 3. You Need Proper Documents

A valid GST invoice or receipt is non-negotiable. It must be in your business’s name, and the supplier must have filed it correctly.

✅ 4. Your Supplier Has to Be Compliant

You only get ITC when your supplier uploads their invoices and pays their GST dues.

In short, if your vendor skips filing, your credit’s on hold. (Yes, your compliance partly depends on someone else’s homework.)

✅ 5. You Must Have Received the Goods or Services

You can’t claim ITC for goods still in transit. The rule’s clear: no delivery, no credit.

3. ITC on Capital Goods — The Big-Ticket Items

Capital goods — think heavy machinery, production equipment, or office computers — also qualify for ITC.

The only difference? You might claim it over time, depending on how the asset is used and the rules that apply.

For example, if you buy a new industrial oven for your bakery, the GST you paid on it can reduce your tax burden down the road.

4. How to Use ITC the Right Way: The Sequence Game

ITC isn’t just a free-for-all credit pool — there’s a proper order to use it across GST types.

Here’s the golden rulebook:

IGST Credit → First used for IGST, then for CGST, then SGST.

CGST Credit → Used for CGST, then IGST.

SGST Credit → Used for SGST, then IGST.

🚫 Cross-usage alert: You can’t use CGST credit to pay SGST (or vice versa). It’s like mixing oil and water — they just don’t blend.

5. Common ITC Pitfalls (and How to Avoid Them)

ITC can save you a lot, but only if you play by the rules. Here’s where most businesses slip up:

❌ 1. Claiming ITC Before Receiving Goods

If your goods are still on the truck, you can’t claim the credit yet. Wait till they land in your warehouse.

❌ 2. Supplier’s Non-Compliance

If your supplier doesn’t file their GST returns, your ITC claim might get stuck. Always deal with compliant vendors — it’s worth it.

❌ 3. Invoice Mismatches

One wrong digit in your GSTIN or invoice number can make your claim vanish into the audit void. Double-check everything.

❌ 4. Delayed Return Filing

File late, and your ITC could be reversed or rejected. It’s not just a paperwork delay — it hits your cash flow too.

❌ 5. Using ITC on Ineligible Expenses

Personal use, exempt supplies, or items like club memberships and employee perks — all off-limits.

6. Real-Life Example

Imagine you’re running a digital marketing agency. You pay ₹18,000 GST on your new laptops (inputs) and charge ₹36,000 GST to clients for your services (output).

Instead of paying ₹36,000 outright, you claim a credit for ₹18,000 — and pay only the difference.

That’s ITC in action: no double taxation, smoother cash flow, happier accountants.

Final Thoughts

Input Tax Credit is one of the most business-friendly features of GST — but it comes with strings attached.

The idea is simple: claim what you paid, but only if you play by the rules.

So, to keep things smooth:

File your GST returns on time.

Work with compliant suppliers.

Keep every invoice squeaky clean.

And maybe, keep your tax advisor on speed dial — just in case.

When managed right, ITC isn’t just a tax credit — it’s a cash flow booster and a competitive edge. Because in business, paying what you owe (and not a rupee more) is just smart strategy.