INDEX

What is Salary

Components of Salary

How to Check Your Tax Deductions from Salary?

Example of Calculation of Income tax on Salary

Retirement Benefits and Tax Exemptions

Income From Salary

1. What Exactly Is Salary?

In plain English: salary is the money your employer pays you for showing up and doing your job. That monthly SMS from your bank? That’s your reward for time, effort, and caffeine consumption.

Your salary slip—that cryptic little document HR emails you—is basically a roadmap showing how your income is sliced and spiced: your basic pay, allowances, perks, and those mysterious deductions.

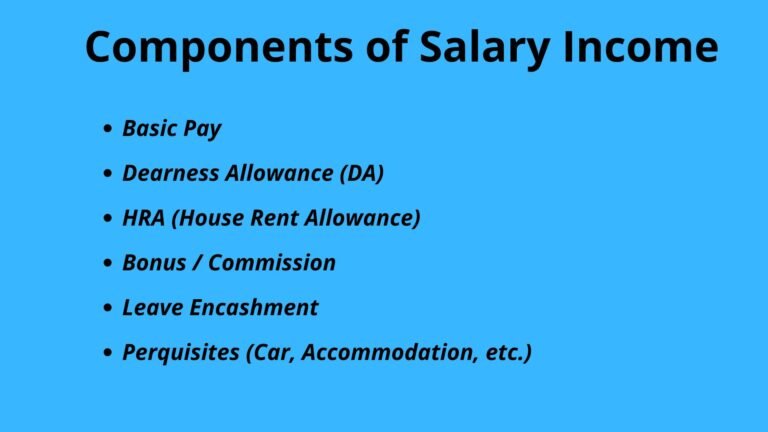

2. Salary Components (a.k.a. Where the Money Goes)

1. Basic Salary

This is the backbone of your income. Think of it as the “core” before all the fancy extras. Usually, it makes up around 35–50% of your gross pay. No bonuses, no incentives—just the plain base. And yes, the taxman loves this part; it’s fully taxable.

2. Allowances — The Salary Add-Ons

Allowances are like the side dishes of your paycheck—different flavors depending on your employer. Some common ones:

Dearness Allowance (DA): Designed to fight inflation blues. Government employees get this to keep pace with rising costs.

House Rent Allowance (HRA): Because not everyone gets a company flat. Rent a place? This can help you claim tax benefits.

Conveyance Allowance: Used to be for your daily commute, but since 2018, it’s been replaced by a standard deduction.

Leave Travel Allowance (LTA): Wanna take a vacation in India? You might get a tax break for that trip—within certain limits.

Books & Periodicals Allowance: For the bookworms (and those who just buy newspapers for crosswords).

3. Provident Fund (PF)

This is your future-you fund. Both you and your employer put in a bit of your salary every month. It sits there, quietly growing, until retirement.

4. Perquisites (a.k.a. Perks)

These are the fun extras—company car, free flat, club membership, maybe even that corner office coffee machine. But don’t get too excited: the taxman counts most of these as income too.

3. Checking Your Tax Deductions

Form 16: The “report card” from your employer showing your total income and TDS (tax deducted at source).

Form 26AS: Your digital tax mirror—you can check it on the TRACES portal to ensure the TDS actually reached the government.

💡 Tax-Saving Moves for Salaried Folks

Here’s where smart planning saves you money and future headaches:

Term Insurance: Life cover + Section 80C deduction. Win-win.

Health Insurance: Medical premiums get you a Section 80D deduction.

ULIPs: A mix of investment + insurance (covered under Section 80C).

PPF: The classic long-term savings plan—safe, tax-friendly, and backed by the government.

NPS: For your retirement planning (Section 80C + extra under 80CCD(1B)).

4. Tax Calculation on Old & New Tax Regime on Salary (AY 2024-25)

Employee Details:

- Basic Salary: ₹6,00,000

- HRA: ₹1,80,000

- Bonus: ₹50,000

- LTA: ₹25,000

- EPF Contribution: ₹72,000

Here’s a detailed salary breakdown for both the Old Tax Regime and New Tax Regime for FY 2023-24 and FY 2024-25, incorporating the salary components you’ve provided.

Old Tax Regime Calculation (for FY 2023-24 & FY 2024-25):

| Particulars | FY 2023-24 (Assessment Year 2024-25) | FY 2024-25 (Assessment Year 2025-26) |

|---|---|---|

| Basic Salary | ₹6,00,000 | ₹6,00,000 |

| House Rent Allowance (HRA) | ₹1,80,000 | ₹1,80,000 |

| Bonus | ₹50,000 | ₹50,000 |

| Leave Travel Allowance (LTA) | ₹25,000 | ₹25,000 |

| EPF Contribution | ₹72,000 | ₹72,000 |

| Gross Salary | ₹9,27,000 | ₹9,27,000 |

| Less: Deductions | ₹50,000 (Standard Deduction) + ₹72,000 (EPF) +25000 = ₹1,47,000 | ₹50,000 (Standard Deduction) + ₹72,000 (EPF) +25000 = ₹1,47,000 |

| Taxable Salary | ₹9,27,000 – ₹1,47,000 = ₹7,80,000 | ₹9,27,000 – ₹1,47,000 = ₹7,80,000 |

| Income Tax Calculation | ||

| – Up to ₹2.5 lakh | ₹0 | ₹0 |

| – ₹2.5 lakh to ₹5 lakh (5%) | ₹2,50,000 * 5% = ₹12,500 | ₹2,50,000 * 5% = ₹12,500 |

| – ₹5 lakh to ₹7.80 lakh (20%) | ₹2,80,000 * 20% = ₹56,000 | ₹2,80,000 * 20% = ₹56,000 |

| Total Income Tax | ₹12,500 + ₹56,000 = ₹68,500 | ₹12,500 + ₹41,100 = ₹68,500 |

| Health and Education Cess (4%) | ₹68,500 * 4% = ₹2,740 | ₹68,500 * 4% = ₹2,740 |

| Total Tax Payable | ₹68,500 + ₹2,740 = ₹71,240 | ₹68,500 + ₹2,740 = ₹71,240 |

New Tax Regime Calculation (for FY 2023-24 & FY 2024-25):

| Particulars | FY 2023-24 (Assessment Year 2024-25) | FY 2024-25 (Assessment Year 2025-26) |

|---|---|---|

| Basic Salary | ₹6,00,000 | ₹6,00,000 |

| House Rent Allowance (HRA) | ₹1,80,000 | ₹1,80,000 |

| Bonus | ₹50,000 | ₹50,000 |

| Leave Travel Allowance (LTA) | ₹25,000 | ₹25,000 |

| EPF Contribution | ₹72,000 | ₹72,000 |

| Gross Salary | ₹9,27,000 | ₹9,27,000 |

| Less: Deductions (Standard Deduction) | ₹72000 (EPF) +50000 (Standard deduction in new Tax Regime)=122000 | ₹72000 (EPF)+ 75000 (Standard deduction in New Tax Regime)=147000 |

| Taxable Salary | ₹8,05,000 | ₹7,80,000 |

| Income Tax Calculation | ||

| – Up to ₹3 lakh | ₹0 | ₹0 |

| – ₹3 lakh to ₹6 lakh (5%)/ ₹3 lakh to ₹7 lakh (5%) | ₹3,00,000 * 5% = ₹15,000 | ₹4,00,000 * 5% = ₹20,000 |

| – ₹6 lakh to ₹8.05 lakh (10%)/ ₹7 lakh to ₹7.80 lakh (10%) | ₹2,05,000 * 10% = ₹20,500 | ₹80,000 * 10% = ₹8,000 |

| Total Income Tax | ₹35,500 | ₹28,000 |

| Health and Education Cess (4%) | ₹35,500 * 4% = ₹1,420 | ₹28,000 * 4% = ₹1,120 |

| Total Tax Payable | ₹36,920 | ₹29,120 |

Summary of Tax Calculation:

Under the Old Tax Regime for FY 2023-24 and FY 2024-25:

- The taxable salary is ₹7,80,000.

- The total tax payable is ₹71,240 (including cess).

Under the New Tax Regime for FY 2023-24 and FY 2024-25:

- The taxable salary is ₹8,05,000 & 7,80,000.

- The total tax payable is ₹36920 & ₹29120 (including cess).

The Old Tax Regime offers more opportunities for deductions (such as EPF contributions and the standard deduction), but the New Tax Regime has lower tax rates and is simpler as it removes most deductions. However, in this case, the New Tax Regime results in a lower tax payable, despite no deductions being allowed.

5. Retirement Benefits & Tax Perks

Leave Encashment:

Govt employees: fully exempt.

Non-govt employees: exempt up to ₹3,00,000 or 10 months’ average salary—whichever’s less.

Section 89(1) Relief:

Got back pay or advance salary? You can get tax relief for the uneven income jump.

Voluntary Retirement (Section 10(10C)):

Walk away early, take a payout—tax-free up to ₹5,00,000.

Pension:

Uncommuted (regular) – taxable.

Commuted (lump sum) – exempt for government employees, partly exempt for others.

Gratuity:

Govt employees: fully exempt.

Others: exempt up to ₹20,00,000 or 15 days’ pay per service year—whichever’s less.