INDEX

- Profits and Gains of Business or Profession – Income Tax

Income from Business or Profession: Definition and Scope

Types of Income Under Profits and Gains of Business or Profession

Computation of Income from Business or Profession

Taxation of Income from Business or Profession

Special Provisions for Professionals

Other Important Aspects

Other Income Classified as Profits and Gains of Business

Income from Business or Profession — Understanding the Real “Working” Income

When you’re running a business or hustling as a professional — whether you’re a startup founder, a doctor, or the guy who designs logos at 2 a.m. — your income doesn’t come neatly labeled as “salary.” It falls under a special category in the Income Tax Act: “Profits and Gains of Business or Profession.”

This is one of the five big “heads of income” that decide how much of your hard-earned cash the taxman takes home. It sits right after Income from Salary and Income from House Property, and it basically covers any money you make from doing business or professional work.

So, if you’re making money by running a company, consulting, designing, trading, or even providing specialized services — this is your home turf.

1. What Counts as “Business or Profession”?

Let’s break it down.

Under Section 28 of the Income Tax Act, income from business or profession means profits or gains that come from:

Any business or profession you’ve carried on during the year (even for part of it).

Activities that are commercial in nature — i.e., you’re doing them to make money, not for fun or charity.

In tax-speak:

“Business” = any activity done with the intention to earn profit.

“Profession” = an occupation that needs special skills or qualifications (think doctors, lawyers, CAs, architects).

Basically: If you’re earning money by using your brains, skills, or hustle — you’re here.

2. What Falls Under This Head of Income?

This head covers a wide range of incomes — some obvious, some sneaky.

Profits from any business:

Income earned from running any kind of business during the financial year.Compensation or contract payments:

Money you get for terminating or modifying a management, agency, or business agreement. (Yes, even breakup money is taxable — if it’s a business breakup.)Trade association income:

If you’re part of a trade or professional group and it earns income by providing services to members, that surplus is taxable here.Export incentives:

Includes perks like:Profit from selling import licenses

Cash assistance or subsidies for exports

Duty drawbacks

Gains from DEPB or DFRC schemes

Business perquisites:

Non-cash benefits or perks arising out of business or profession. (Think free assets or services.)Partner’s earnings:

Interest, salary, bonus, or commission that a partner receives from their firm.Payments for non-compete agreements:

If someone pays you not to carry on a business, or not to share trade secrets — that money’s taxable too.Keyman insurance policy:

Any sum received under such a policy (including bonuses) is taxable.Money from damaged or discarded assets:

If you’ve written off an asset under Section 35AD and later sell or scrap it — that recovery counts as business income.

3. How to Compute Income from Business or Profession

Here’s the recipe:

Start with Gross Receipts — all your business income, including sales, fees, and other earnings.

Subtract Allowable Deductions — all the expenses that the law allows.

These deductions (Sections 30–37) include:

🏢 Rent, taxes, and utilities for business premises.

🧾 COGS (Cost of Goods Sold): the direct costs of whatever you sold.

💻 Depreciation on fixed assets (as per Section 32).

💸 Interest on business loans.

👩💼 Salaries and wages to employees.

🚗 Travel, office, and admin expenses.

❌ Bad debts that you’ve had to write off.

After all that, what’s left is your Net Profit (or Loss) — your taxable business income.

And if the result is a loss? Don’t panic. You can carry it forward for up to 8 years to set off against future profits (Section 72).

4. Taxation Rules — Who Pays What

Individuals and HUFs: taxed as per their income slab rates.

Companies: taxed at corporate tax rates.

Professionals: taxed similarly, though some get special provisions (like presumptive schemes).

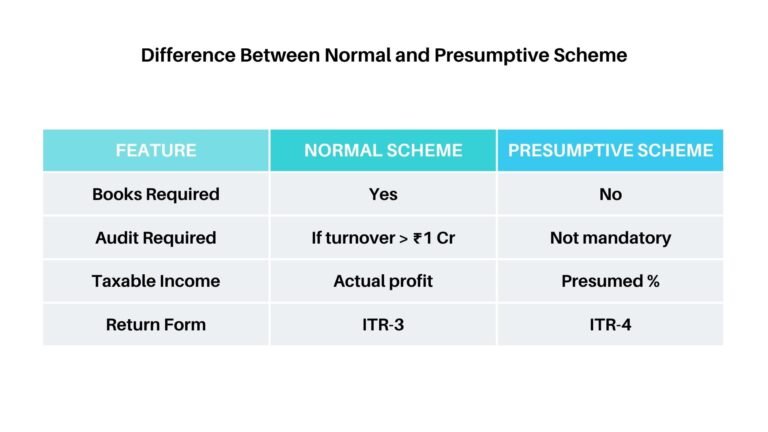

🚚 Presumptive Taxation — The Shortcut Route

If you hate bookkeeping (and who doesn’t?), the Income Tax Act gives you a few easy ways to declare income under presumptive taxation.

Section 44AD:

Small businesses with turnover ≤ ₹2 crore can declare 8% of turnover (or 6% if digital) as taxable income.Section 44ADA:

For professionals (doctors, lawyers, consultants) with receipts ≤ ₹50 lakh — 50% of receipts are treated as income.Section 44AE:

For goods transporters — fixed income per vehicle per month.

No need to maintain detailed books — just pay tax on the presumed income and move on.

💰 Advance Tax — Pay As You Earn

If your total tax liability exceeds ₹10,000 in a year, you need to pay advance tax in installments. Miss those payments, and Sections 234B & 234C will greet you with interest charges.

5. Special Rules for Professionals

Certain professionals — doctors, CAs, lawyers, architects — have to keep their books squeaky clean:

Section 44AA: Must maintain books of accounts if receipts exceed ₹1.5 lakh in any of the last 3 years.

Section 44AB: If your income exceeds ₹50 lakh or turnover crosses ₹1 crore — tax audit time.

6. Other Important Bits

Business Losses: Can be set off against other income (except salary) or carried forward for 8 years.

Preliminary Expenses: Startup or setup expenses can be spread over 5 years.

Tax Audit (Section 44AB): Required if your turnover crosses the prescribed limit.

7. Odd But Taxable Cases

Even if you didn’t actively run a business this year, certain incomes still fall under this head:

Recovery of old losses or expenses previously deducted.

Selling capital assets used for scientific research.

Recovery of bad debts.

Withdrawals from special reserves.

Receipts from discontinued businesses (under cash accounting).

Because once business income, always business income — at least according to the Income Tax Department.

Final Thoughts

The “Profits and Gains of Business or Profession” head is where your real entrepreneurial effort meets the tax law. It’s broad, it’s detailed, and yes — it’s a maze. But if you understand what counts as business income, what you can deduct, and when you can simplify under presumptive schemes, you’ll save yourself a lot of headaches (and maybe a few late-night caffeine-fueled spreadsheet sessions).