INDEX

GST on Cryptocurrency: The Taxman Meets the Blockchain

What Even Is Cryptocurrency Under GST?

Goods or Services? The Classification Game

Who’s Supposed to Pay the GST?

The Missing HSN Code and the “Guess Rate”

Can You Claim Input Tax Credit (ITC) for Crypto Expenses?

Advance Rulings and the Ongoing Gray Zone

So, What’s the Bottom Line?

GST on Cryptocurrency

1. GST on Cryptocurrency: The Taxman Meets the Blockchain

When the Indian government rolled out the 2022 Budget, crypto traders everywhere collectively held their breath. That was the year digital assets officially got their own tax seat — a 30% income tax on profits, a 1% TDS on trades, and a big, fat “no” to offsetting losses. But one thing was left hanging in the air like a mystery coin flip:

What about GST?

Does buying or selling Bitcoin, Ethereum, or your favorite meme token count as a “supply” under GST law? Should traders register and start collecting tax like shopkeepers? The government didn’t exactly spell it out — which means India’s crypto community has been trying to piece it together ever since.

2. What Even Is Cryptocurrency Under GST?

Here’s where things start getting fuzzy. The GST Act doesn’t mention “crypto,” “digital assets,” or even “virtual coins.” So, we have to borrow the 2022 Budget’s definition of Virtual Digital Assets (VDAs) — which includes any code, token, or number that can be traded or transferred digitally for value.

So yes — that covers:

Cryptocurrencies like Bitcoin and Ethereum,

Non-Fungible Tokens (NFTs), and

Any other shiny blockchain-based token the government decides fits the bill.

But what’s not included? The old-school stuff — actual money like rupees or dollars.

3. Goods or Services? The Classification Game

GST draws a hard line between “goods” and “services.”

Goods = movable property (except money and securities).

Services = everything that’s not goods, money, or securities.

Since crypto isn’t money (it’s not legal tender) and isn’t a security under Indian law, it falls under the “goods” bucket.

That means:

✅ Crypto is taxable under GST, unless specifically exempted (and spoiler — it’s not).

✅ Every trade, exchange, or sale is technically a “supply of goods.”

So, when you sell Bitcoin for cash or swap Ethereum for USDT, you’re making a taxable supply — at least in theory.

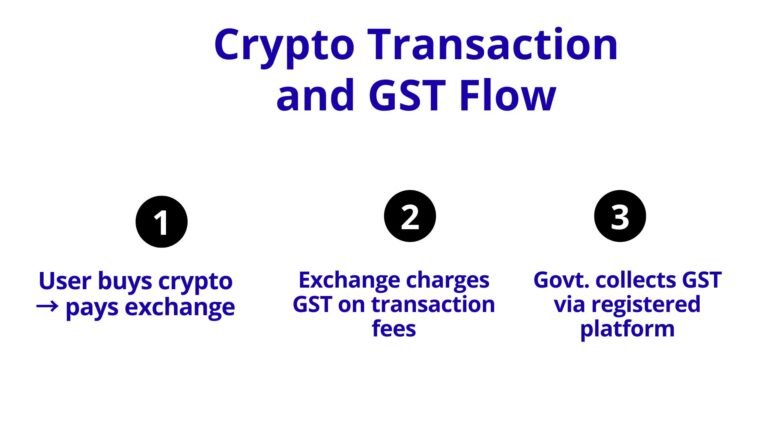

4. Who’s Supposed to Pay the GST?

Under GST law, the supplier of goods or services collects the tax.

So, in crypto-land, that means:

If you’re an exchange, you’re the supplier and must collect GST on your fees.

If you’re an individual seller trading directly with someone, technically you may be liable — though good luck applying that rule across decentralized platforms.

In short: whoever facilitates the sale, collects the tax.

5. The Missing HSN Code and the “Guess Rate”

The GST Council hasn’t assigned crypto its own category or HSN (Harmonized System of Nomenclature) code. So, businesses have been winging it with HSN Code 960899 — “other miscellaneous articles.”

This puts crypto trades under an 18% GST slab, the same as luxury goods or digital consulting services.

But here’s the catch: only businesses crossing a ₹40 lakh turnover threshold (or those registered voluntarily) need to pay GST. Individual hobby traders? You’re technically outside that net — for now.

Government of India GST Law (for in-depth legal provisions regarding GST).

Link: https://www.cbic.gov.in/

6. Can You Claim Input Tax Credit (ITC) for Crypto Expenses?

If you’re running a registered crypto business — say, an exchange, consultancy, or blockchain service provider — yes, you can claim ITC on certain expenses.

That includes GST paid on:

Brokerage or exchange fees,

Legal or tax consultancy,

Trading software or analytics tools,

Infrastructure or computing costs.

But — and it’s a big but — personal transactions don’t qualify. You can’t buy Bitcoin on a Sunday night and claim ITC because “it’s research.”

(For more Detailed Info. on Input Tax Credit)

7. Advance Rulings and the Ongoing Gray Zone

Several Indian crypto exchanges have already approached GST authorities for advance rulings, asking the million-dollar question: how exactly do we apply GST to digital assets?

The market’s no small fry — India reportedly has over 10 crore crypto investors and ₹400 crore+ in crypto holdings — so the pressure for clarity is real.

But as of 2025, the government’s position remains… well, let’s call it work in progress. The classification of crypto as “goods” makes logical sense, but the absence of a clear GST framework leaves everyone — traders, accountants, and even tax officers — guessing.

Conclusion

The taxation of cryptocurrencies and digital assets under GST remains an evolving area. While cryptocurrencies are categorized as goods under GST, there is still no clear framework for their taxation. The 18% GST rate, based on HSN Code 960899, applies to cryptocurrency transactions, but businesses must stay alert for any future updates or clarifications from the government.

As stakeholders continue to seek clarity on these issues, it is essential for businesses and traders to stay informed and adapt to the ever-changing landscape of cryptocurrency taxation in India. Until a comprehensive, universally accepted approach is established, navigating GST in the cryptocurrency space remains challenging and subject to ongoing debate and interpretation.