INDEX

- GST Rates on Hospitality Services

- Impact of GST on the Hospitality Sector

- Challenges Faced by the Hospitality Industry Under GST

- Recent Developments in GST for the Hospitality Inudstry

GST and the Indian Hospitality Industry

GST and the Indian Hospitality Industry: Serving Taxes with a Side of Confusion

When India flipped the switch on the Goods and Services Tax (GST) on July 1, 2017, every industry felt the tremors — and the hospitality sector definitely wasn’t spared. Think of it as a massive menu rewrite for hotels, restaurants, and travel services. Suddenly, the old tax buffet — VAT, service tax, luxury tax, you name it — was replaced by one big “all-inclusive” dish called GST.

Sounds simpler, right? Well, kind of. While GST brought much-needed consistency and transparency, it also added a few new layers of complexity that had hoteliers, restaurateurs, and tour operators scratching their heads.

So, let’s dig in — how exactly has GST changed the business of serving food, comfort, and wanderlust in India?

1. GST on Hotels, Restaurants, and Travel — Who Pays What

GST in hospitality depends heavily on where you stay, what you eat, and how you move. Rates vary like room tariffs in peak season.

🏨 Hotels and Accommodation

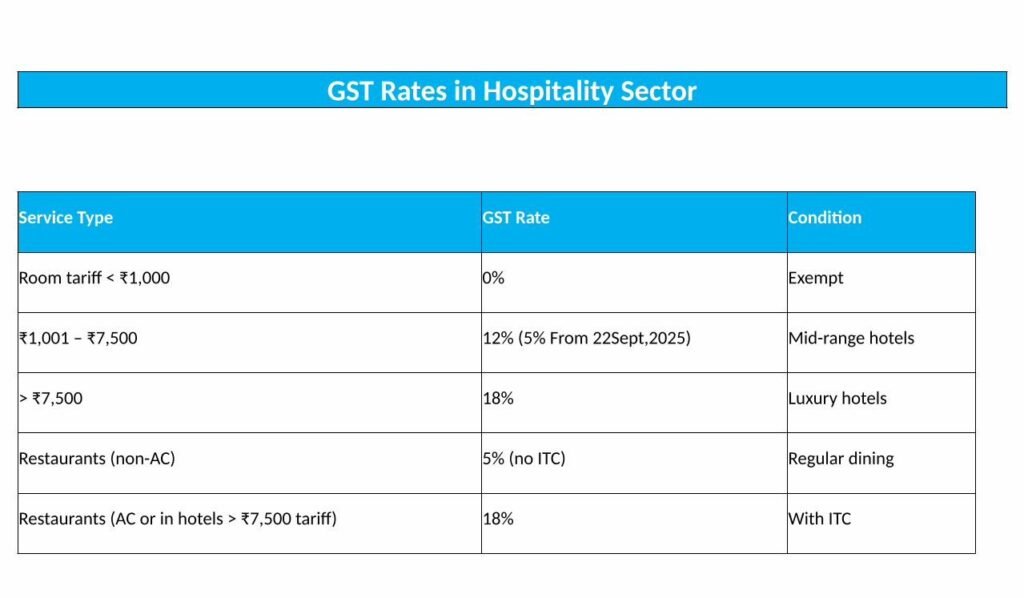

Room tariffs basically decide your tax fate. Here’s the (ever-evolving) breakdown:

Below ₹1,000/night: No GST. Sleep tight, no tax bite.

₹1,000–₹7,500/night: (W.E.F. Sept 25, 2025) A flat 5% GST applies, but sorry — no Input Tax Credit (ITC).

Above ₹7,500/night: 18% GST with full ITC benefits — so fancy hotels pay more tax but can claim more credit.

(Before the recent update, rates ranged between 12% and 28%. The 2025 change smooths things out a bit, finally.)

🍴 Restaurants and Eateries

Here’s how the tax plate is served:

Non-AC joints and those not serving alcohol: 5% GST, no ITC.

AC restaurants or those pouring drinks: 18% GST, ITC allowed.

Cafes and fast-food chains: Usually 5% — unless booze is involved.

Essentially, if your place serves chilled beer or cool air, expect the taxman to charge a premium.

✈️ Tourism and Travel Services

Tour operators, travel agents, and package sellers all have their slice of GST to chew on:

Tour operators: 5% GST (no ITC).

Tourism services — think hotel bookings, travel packages, guided tours: generally 18% GST.

Air travel: Domestic flights attract 5% GST, while international flights remain mostly exempt — a small mercy for jet-setters.

👉 For the full rulebook (if you dare): Goods & Services Tax (GST) | Home

2. How GST Has Shaken Up the Hospitality Game

A Simpler Tax Regime (On Paper, at Least)

Before GST, hotels and restaurants had to juggle VAT, service tax, excise duty, luxury tax — the works. Now it’s all under one roof. Fewer forms, fewer authorities, and a little less midnight panic for accountants.

Input Tax Credit: The Good, the Bad, and the Ugly

For big hotels and restaurant chains, ITC is a blessing. They can offset taxes paid on inputs like food, furniture, linens, and wine bottles. It smooths out cash flow and keeps margins healthy.

But for small hotels and eateries under the 5% GST slab, it’s a rough deal — no ITC allowed. That means they pay tax on everything they buy but can’t reclaim a rupee of it. So while their GST looks low, their costs quietly climb.

Compliance Headaches

Yes, GST simplified taxation — but it also made bookkeeping a full-time sport. Hotels and restaurants must now keep exhaustive records, match invoices, and file returns on a strict schedule. Big players manage with software and tax pros. Small ones? They’re often drowning in forms.

Impact on Pricing and Demand

Luxury stays became pricier thanks to high GST slabs (initially up to 28%). Some guests blinked, some booked anyway.

Budget spots benefited from lower taxes, but without ITC, profits got squeezed.

For diners, 5% GST looks friendly — but when restaurants can’t claim ITC, menu prices quietly rise to cover the gap.

3. Hospitality’s Ongoing Challenges Under GST

Even eight years later, the industry’s still finding its footing. Here’s what’s keeping owners up at night (besides late-night check-ins):

1. Small Hotels Can’t Catch a Break

Budget hotels, guesthouses, and homestays are taxed at 5% but get no ITC. So they eat the tax on every input — from cleaning supplies to kitchen gas. The result? Thinner margins, tougher competition, and not much room to drop prices.

2. Paperwork, Paperwork, Paperwork

GST compliance means detailed invoices, digital filing, and monthly returns. Small-town operators without accounting teams often struggle to stay compliant — and penalties for late filings sting hard.

3. Too Many Rate Slabs, Too Much Confusion

The system still feels patchy. Some hotels are taxed at 5%, others at 18%. Some restaurants can claim ITC, others can’t. The patchwork makes pricing and planning a bit of a guessing game.

4. Consumers Paying More for “Luxury”

For domestic travelers, those 18% and 28% GST rates on high-end hotels add up fast. Sure, the industry benefits from transparency, but the average tourist feels the pinch.

4. What’s New on the GST Menu

The government’s been tweaking the recipe to make things more palatable:

Exemption for budget hotels: Rooms under ₹1,000/night stay GST-free — huge relief for small businesses and backpacker stays.

Air travel adjustment: Domestic flights taxed at 5% (international mostly exempt). Keeps travel costs manageable and tourism buzzing.

Tourism promotion push: Lower GST for tour operators and package services aims to make India a more wallet-friendly destination.

These steps don’t fix everything, but they show that the government’s at least listening to industry feedback.

Conclusion: A Work in Progress, But Getting There

GST has definitely shaken up India’s hospitality industry — for better and for worse. It’s cleaner, more transparent, and easier to track. But small hotels and local eateries still feel squeezed by compliance costs and the loss of ITC.

Luxury chains can navigate the system with teams of accountants; family-run lodges often just wing it. Still, with exemptions for budget stays, lower rates on air travel, and government efforts to boost tourism, there’s hope the sector will find its balance.

India’s hospitality industry is resilient — and if it can survive pandemic lockdowns, staffing shortages, and fickle travelers, it can surely survive GST’s growing pains too.