INDEX

GST Tax Structure in Real Estate

Impact of GST on Developers

Impact of GST on Home Buyers

Role Of Input Tax Credit (ITC) in Real Estate Transactions

Challenges Faced By the Real Estate Sector Post-GST

GST and Real Estate

GST and Real Estate: What’s Really Going On with Property Taxes

When GST (Goods and Services Tax) rolled into town on July 1, 2017, India’s real estate sector had to do a serious double-take. Before that day, buying or selling property meant dealing with a confusing cocktail of taxes — VAT, service tax, stamp duty — each one waiting to trip you up somewhere along the process. GST was supposed to be the cleanup act: one tax to rule them all, fewer layers, and (hopefully) fewer headaches.

It did make things simpler in some ways. But, as with most “simplifications” in India’s tax world, the story isn’t quite that tidy. Developers, builders, and homebuyers all got a taste of both the good and the frustrating sides of this shiny new system.

1. How GST Actually Works in Real Estate

GST splits property transactions into two big buckets — the sale of land or completed buildings and construction services. And yes, they’re taxed differently.

Sale of Land or Completed Buildings: The Tax-Free Zone

This one’s the easy part. If you’re buying a property that’s already complete — keys in hand, ready to move in — there’s no GST on that sale. Same goes for land. The logic? Once it’s built, it’s no longer a “service.”

Construction and Development Services: Where the Tax Man Enters

If the property is still a work in progress, GST applies.

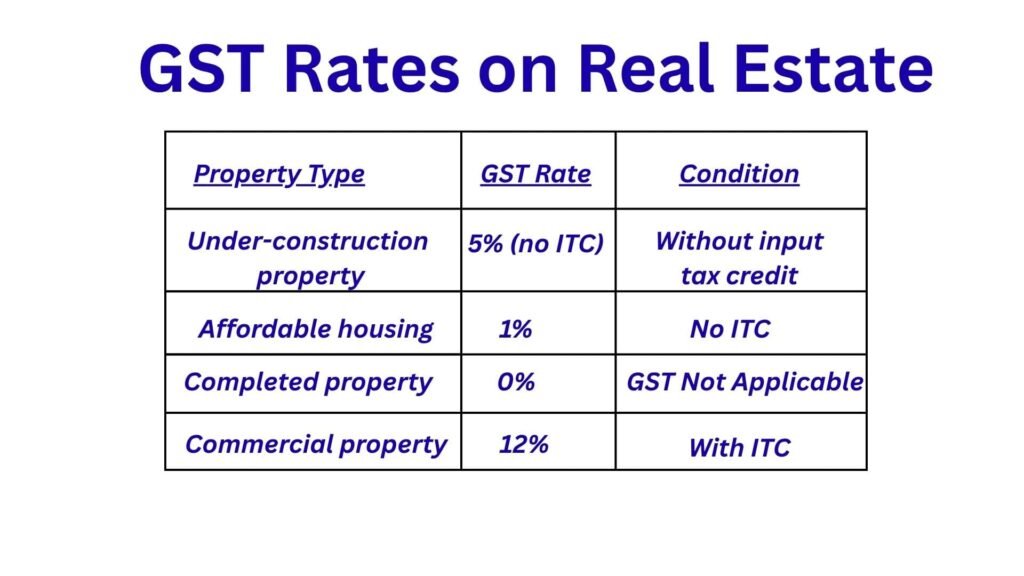

Residential Properties: Under-construction homes get hit with 5% GST, unless it’s an affordable housing project — then it drops to 1%. To qualify as “affordable,” the flat needs to stay within specific size and price limits.

Commercial Properties: Under-construction offices or shops attract 12% GST, but developers here get a nice perk — they can claim Input Tax Credit (ITC) on the materials and services they use.

Those rates have held steady since GST launched — no nasty surprises (yet).

👉 For the brave, here’s the official rulebook: cbic.gov.in

2. Developers Under GST: Winners, Losers, and Headaches

The Good: Simpler, Cleaner, More Transparent

Gone are the days of juggling service tax, VAT, and who-knows-what. GST rolled everything into one big umbrella, which makes compliance easier and pricing clearer — at least on paper.

The Mixed Bag: Input Tax Credit (ITC)

Developers of commercial projects can use ITC to offset their tax bill — meaning less money stuck in limbo. But residential developers? Nope. They lost that privilege, which means their costs go up, and so do property prices.

The Pain Points: Cash Flow and Costs

Residential blues: Since ITC is off the table, residential construction just got pricier. Builders pass that extra cost straight to buyers.

Cash crunch: Developers pay GST while building, but buyers often pay after completion. So money’s always flowing out faster than it’s coming in.

It’s a well-documented gripe — and honestly, they’re not wrong.

3. Homebuyers and GST: The Real Impact

For buyers, GST brought a mix of good news and “ugh, really?” moments.

Affordable housing win: The 1% GST on affordable homes is genuinely helpful. It makes entry-level housing more accessible for first-time buyers.

Under-construction premium: But if you’re buying an under-construction flat, that 5% GST makes it pricier than a ready-to-move-in property (which, remember, has zero GST).

Market jitters: When GST first hit, the property market wobbled — developers weren’t sure how to price things, and buyers got cold feet. The dust has settled somewhat, but confusion still pops up now and then.

4. The Infamous Input Tax Credit (ITC): Who Really Wins?

ITC is basically GST’s “get some of your money back” feature. Developers can claim credit for the tax they’ve already paid on construction materials like cement, steel, and tiles.

Commercial developers: They can use ITC to lower their costs — a genuine plus.

Residential developers: Nope, no ITC for them. So their costs pile up, and buyers end up footing the bill.

Refunds for excess GST do exist, but the process moves about as fast as Sunday traffic in Bengaluru. Slow refunds = frozen cash flow = frustrated developers.

5. Real Estate’s Ongoing GST Struggles

Even though GST simplified a lot of things on paper, the real-world version is… let’s say “work in progress.”

Compliance fatigue: Developers now have to file returns, reconcile invoices, and basically live inside their GST portal. Small builders, especially, are drowning in paperwork.

Liquidity crunch: Paying GST upfront while waiting months for buyer payments or refunds can squeeze even big players.

Price creep: Without ITC, residential prices inch upward, leaving middle-income buyers feeling the pinch.

Conclusion: GST’s Real Estate Reality Check

GST was meant to clean up India’s messy tax web, and in fairness, it did untangle a good chunk of it. It’s more transparent, less fragmented, and easier to follow than before. But it also nudged costs upward for residential projects and made developers’ cash flows tighter.

Commercial builders got the better deal (thanks to ITC), while homebuyers now do mental math before deciding between a ready-to-move home or one still wrapped in scaffolding.

In short — GST gave the real estate world a bit of both: clarity and chaos. With a few policy tweaks — maybe restoring ITC for residential projects or faster refunds — the system could finally hit that sweet spot between fair and functional.