INDEX

What is GST Return?

Who Should File GST Returns?

Types of GST in India

ITC Utilization and Sequence

GST Returns along with Due Date

- Key GST Return Filing Notes:

GST RETURN

1. What Is a GST Return?

A GST return is basically a report card your business files with the government. It tells the tax department how much you sold, how much you bought, and how much tax you’ve already paid versus what you owe.

Every GST-registered business has to file it — it’s how the system keeps track of who owes what and ensures everyone pays (or gets refunded) fairly.

In simple terms:

Income/Sales = what you earned

Purchases/Expenses = what you spent

Output GST = tax collected on your sales

Input Tax Credit (ITC) = tax you’ve already paid on purchases

When you file your return, the government tallies it all up to see your net tax liability — whether you need to pay more or you’ve paid enough already.

🔗 For more details or to file your return, visit the official GST Portal

2. Who Needs to File GST Returns?

If you’re registered under GST, there’s no escaping it — you’ve got to file returns. Here’s who’s on the list:

Regular GST-registered businesses – For those crossing the turnover threshold.

Composition scheme taxpayers – Small businesses that prefer a simplified tax option (with turnover limits).

E-commerce operators & aggregators – Platforms like Amazon, Flipkart, or aggregators handling transactions must file specific returns.

Non-resident taxable persons (NRTPs) – Foreign businesses supplying goods or services in India.

Input Service Distributors (ISD) – Businesses distributing input tax credits to their branches.

💡 Tip: Even if your turnover is nil, many returns still need to be filed. Skipping a return can snowball into penalties quickly.

Special Categories of States and UTs

Some due dates depend on where you’re registered.

Here’s the quick split:

Category X States/UTs

States: Chhattisgarh, Madhya Pradesh, Gujarat, Maharashtra, Karnataka, Goa, Kerala, Tamil Nadu, Telangana, Andhra Pradesh.

UTs: Daman & Diu, Dadra & Nagar Haveli, Puducherry, Andaman & Nicobar Islands, Lakshadweep.

📅 GSTR-3B (QRMP Scheme) Due Date: 22nd of the month following the quarter.

Category Y States/UTs

States: Himachal Pradesh, Punjab, Uttarakhand, Haryana, Rajasthan, Uttar Pradesh, Bihar, Sikkim, Arunachal Pradesh, Nagaland, Manipur, Mizoram, Tripura, Meghalaya, Assam, West Bengal, Jharkhand, Odisha.

UTs: Jammu & Kashmir, Ladakh, Chandigarh, Delhi.

📅 GSTR-3B (QRMP Scheme) Due Date: 24th of the month following the quarter.

📝 Always check CBIC notifications — due dates can (and do) change.

🔗 Central Goods and Services Tax (CGST) Act, 2017

3. Types of GST in India

GST in India is split into three types — each handling a different layer of trade and governance:

| Type | Full Form | Who Collects | Used For |

|---|---|---|---|

| CGST | Central Goods and Services Tax | Central Government | National-level programs, infrastructure, and services |

| SGST | State Goods and Services Tax | State Governments | Regional projects like roads, education, and welfare |

| IGST | Integrated Goods and Services Tax | Central Government (shared with States) | Inter-state transactions and fair revenue distribution |

Together, CGST + SGST + IGST make sure both the Centre and States get their fair share, keeping trade smooth and governance balanced.

4. ITC Utilization and Sequence

Think of Input Tax Credit (ITC) as prepaid tax money that can offset what you owe. But there’s a specific order for using it.

Here’s the ITC Utilization Flow:

Use CGST Credit → to pay CGST first.

Use SGST Credit → to pay SGST first.

Use IGST Credit → to pay IGST, then CGST, then SGST (in that order).

Cross-utilization rules:

CGST credit can cover CGST and IGST, not SGST.

SGST credit can cover SGST and IGST, not CGST.

IGST credit is the most flexible.

🚫 Important: You can’t use CGST to pay SGST, or vice versa. The government’s pretty strict about that one.

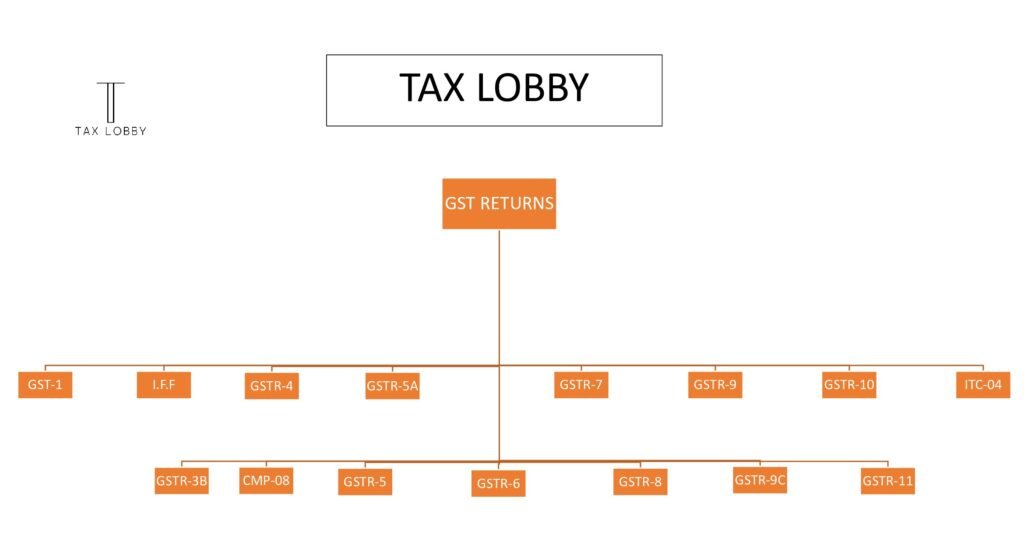

5. GST Returns and Their Due Dates (At a Glance)

| Return | Description | Frequency | Due Date |

|---|---|---|---|

| GSTR-1 | Outward supply details | Monthly / Quarterly (QRMP) | 11th (monthly) / 13th (quarterly) |

| IFF | B2B invoice details (QRMP) | Monthly (first two months of the quarter) | 13th of next month |

| GSTR-3B | Summary return (sales, ITC, tax) | Monthly / Quarterly | 20th (monthly), 22nd/24th (QRMP) |

| CMP-08 | Tax payment for composition dealers | Quarterly | 18th of the month after the quarter |

| GSTR-4 | Annual return for composition taxpayers | Annually | 30th April (FY 2023–24); from FY 2024–25 → 30th June |

| GSTR-5 | Return for non-resident taxable persons | Monthly | 13th (updated) |

| GSTR-5A | Return for OIDAR service providers | Monthly | 20th |

| GSTR-6 | Input Service Distributor return | Monthly | 13th |

| GSTR-7 | TDS details | Monthly | 10th |

| GSTR-8 | TCS details (E-commerce operators) | Monthly | 10th |

| GSTR-9 | Annual return for regular taxpayers | Annually | 31st December (next FY) |

| GSTR-9C | Reconciliation statement (turnover > ₹5 Cr) | Annually | 31st December (next FY) |

| GSTR-10 | Final return after registration cancellation | Once | Within 3 months of cancellation |

| GSTR-11 | Refund claim by UN or UIN entities | Monthly | 28th |

| ITC-04 | Goods sent/received for job work | Annually / Half-yearly | 25th April / 25th Oct & 25th Apr |

Quick Recap

File your returns on time — it saves you from penalties and interest.

Keep your ITC claims accurate — wrong reporting can freeze refunds.

Always check CBIC notifications — due dates sometimes shift.

And yes, nil returns still count as returns.

✅ Bottom line: GST compliance isn’t just about ticking boxes — it’s about keeping your business smooth, penalty-free, and ready for growth.