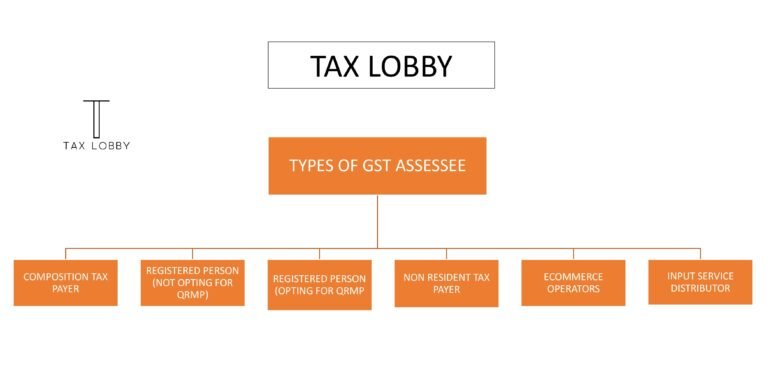

INDEX

Composition Taxpayer

Registered Person (Not opted for QRMP Scheme)

Registered Person (Opted for QRMP Scheme)

Non Resident Tax Payer

E-commerce Operators

Input Service Distributor

GST Applicability for Different Types of Assessees

Let’s make sense of who files what, when, and why — because with GST, missing a due date can mean way more headaches than necessary.

1. Composition Taxpayer

| Form / Function | Due Date* | Period | Who Files | Description |

|---|---|---|---|---|

| CMP-08 (Quarterly) | 18th April (or 18th of the month following the quarter) | Jan–Mar ’24 | Composition Taxpayer (Quarterly) | Filed quarterly by composition taxpayers to pay tax and furnish a challan-cum-statement in one go. |

| GSTR-4 (Annually) | 30th April | FY 2023–24 | Composition Dealer | Annual return for taxpayers who’ve opted for the composition scheme. |

Link: https://www.gst.gov.in/

2. Registered Person (Not Opted for QRMP Scheme)

| Form / Function | Due Date* | Period | Who Files | Description |

|---|---|---|---|---|

| GSTR-1 (Monthly) | 11th April | March ’24 | Registered Person | For taxpayers with turnover above ₹5 crore or those who didn’t choose the QRMP scheme. Summarizes outward supplies. |

| GSTR-3B (Monthly) | 20th April | March ’24 | Registered Person | Monthly summary return for taxpayers with turnover above ₹5 crore (or not under QRMP). |

| GSTR-9 (Annual Return) | 31st Dec (Next FY) | FY 2023–24 | Registered Person with turnover > ₹2 Cr | Consolidated annual return for all monthly/quarterly GST filings. |

| GSTR-9C (Reconciliation Statement) | 31st Dec (Next FY) | FY 2023–24 | Registered Person with turnover > ₹5 Cr | Audit report and reconciliation statement for GSTR-9. |

📘 Refer to: CBIC – Government of India GST Law

3. Registered Person (Opted for QRMP Scheme)

| Form / Function | Due Date* | Period | Who Files | Description |

|---|---|---|---|---|

| GSTR-1 (Quarterly) | 13th April | Jan–Mar ’24 | Registered Person | Summary of outward supplies for taxpayers under the QRMP scheme. |

| GSTR-3B (Quarterly) | 22nd April | Jan–Mar ’24 | Registered Person | Summary return for QRMP taxpayers registered in Category X states or UTs. |

| GSTR-3B (Quarterly) | 24th April | Jan–Mar ’24 | Registered Person | Same as above, but for Category Y states or UTs. |

| GSTR-9 (Annual Return) | 31st Dec (Next FY) | FY 2023–24 | Registered Person (turnover > ₹2 Cr) | Consolidated annual return. |

| GSTR-9C (Reconciliation Statement) | 31st Dec (Next FY) | FY 2023–24 | Registered Person (turnover > ₹5 Cr) | Reconciliation statement and audit report. |

💡 Tip: If you’re using the Invoice Furnishing Facility (IFF), you only need to upload B2B invoices for March 2024 in GSTR-1, since January and February are already covered.

4. Non-Resident Taxpayer

| Form / Function | Due Date* | Period | Who Files | Description |

|---|---|---|---|---|

| GSTR-5 (Monthly) | 13th April | March ’24 | Non-Resident Taxpayer | Summary of outward taxable supplies and tax payable by non-residents. |

🔗 Reference: The Central Goods and Services Tax (CGST) Act, 2017

5. Tax Deductors & E-Commerce Operators

| Form / Function | Due Date* | Period | Who Files | Description |

|---|---|---|---|---|

| GSTR-7 (Monthly) | 10th April | March ’24 | Tax Deductor | Details of tax deducted at source (TDS) and deposited under GST. |

| GSTR-8 (Monthly) | 10th April | March ’24 | E-Commerce Operator | Details of tax collected at source (TCS) by e-commerce operators. |

| GSTR-9B (Annual) | 31st Dec (Next FY) | FY 2023–24 | E-Commerce Operator | Annual return for operators required to collect tax under Section 52. |

| GSTR-9C (Reconciliation Statement) | 31st Dec (Next FY) | FY 2023–24 | Taxpayers with turnover > ₹5 Cr | Audit and reconciliation statement linked with GSTR-9. |

6. Input Service Distributor (ISD)

| Form / Function | Due Date* | Period | Who Files | Description |

|---|---|---|---|---|

| GSTR-6 (Monthly) | 13th April | March ’24 | Input Service Distributor | Details of Input Tax Credit (ITC) received and distributed by the ISD. |

A Quick Note for Small Taxpayers

If your turnover is up to ₹5 crore (current or previous FY), you can opt in or out of the QRMP scheme for April–June 2024 by 30th April 2024.

🕒 Remember: These due dates are subject to official changes. Always double-check notifications from the GST Department before filing.

Category X States / UTs: Chhattisgarh, MP, Gujarat, Maharashtra, Karnataka, Goa, Kerala, Tamil Nadu, Telangana, Andhra Pradesh, Daman & Diu, Dadra & Nagar Haveli, Puducherry, Andaman & Nicobar, Lakshadweep.

Category Y States / UTs: HP, Punjab, Uttarakhand, Haryana, Rajasthan, UP, Bihar, Sikkim, Arunachal Pradesh, Nagaland, Manipur, Mizoram, Tripura, Meghalaya, Assam, West Bengal, Jharkhand, Odisha, Jammu & Kashmir, Ladakh, Chandigarh, Delhi.

Government of India GST Law (for in-depth legal provisions regarding GST).

Link: https://www.cbic.gov.in/